Buying the bounce: a trader’s guide to making the most of volatility

We’ve seen over the last 18 months that while the ASX continues its seemingly inexorable rise, volatility is increasing.

Decisions like whether the market overvalued, whether we are closer to the end of the bull run than the start and whether it’s time to move to cash are on many investors’ minds.

So how do you trade in such a market?

One strategy I often use in times of high volatility can be summed up by one word – bounce.

Now, let me be clear, this can be a high-risk trading strategy and is not for everyone.

It’s not a buy and hold approach. Traders employing it will likely lose sleep, and often money.

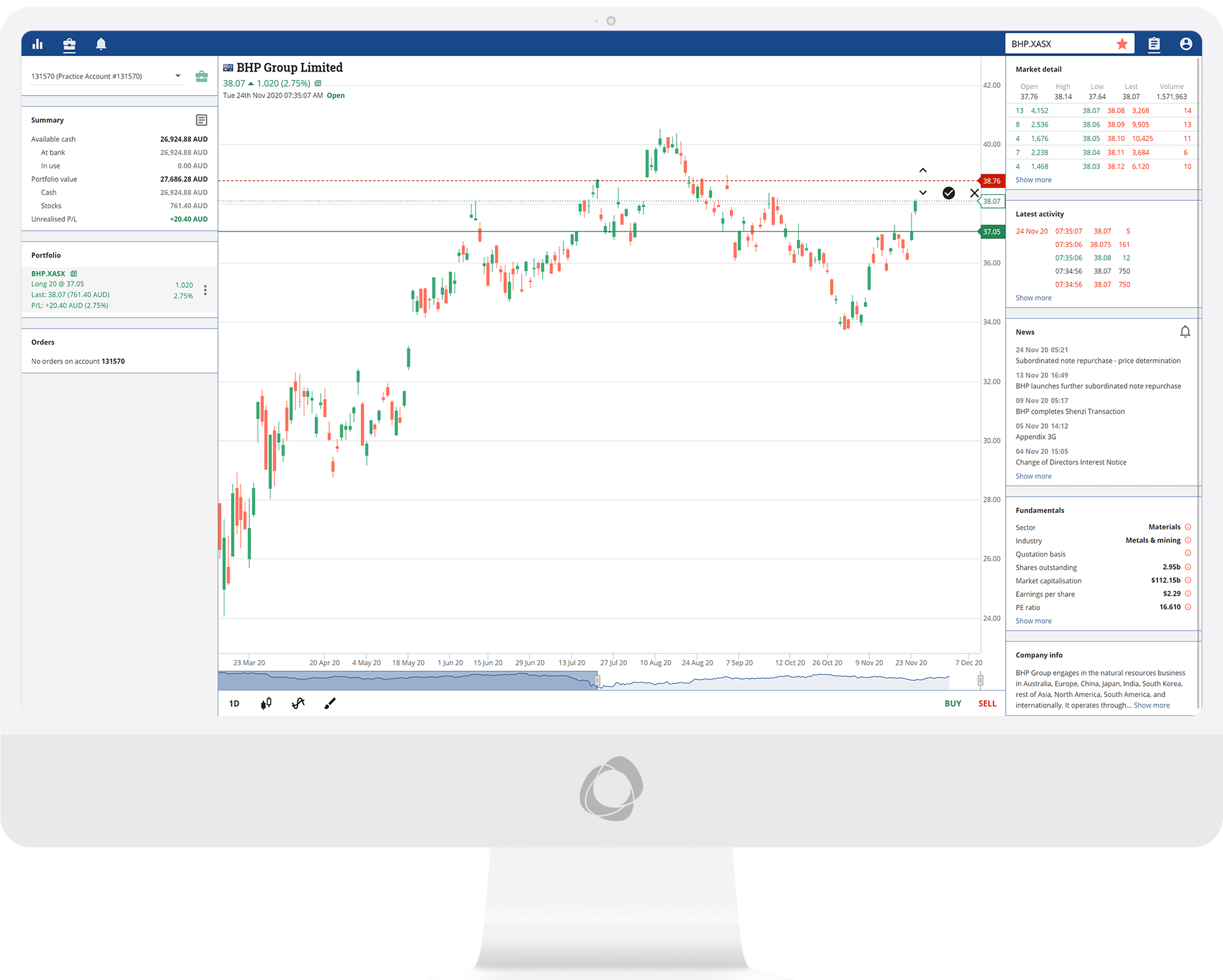

It is about getting in and out at the right time. To do it well you need to have the right tools and technology – like live-streaming pricing and real time alerts – to actively monitor and time your entry and exit.

Spotting the bounce opportunity: Tyro

Business payments platform Tyro provides a good recent example for me to explain the bounce strategy.

Tyro is a $1.5b company, but still unprofitable. Like Afterpay it remains highly speculative even though it is relatively big.

But, these large, high risk, unprofitable tech plays – where sentiment can quickly swing from “I’ll never sell this stock” to “OMG how am I down so much” – can provide the backdrop for a great bounce opportunity.

For the bounce strategy to work, you need to wait for the right catalyst.

Tyro’s share price had failed to breach the $4.50 price point three times in a year. “Triple tops” are believed by many to be a foreteller of doom. It is a fairly common technical indicator, showing that the stock is no longer rallying and will potentially lead to a decline.

In other words, it’s not going up so it will probably go down.

Equally, the tops all coincided with a spike in the RSI, which is the ‘relative strength indicator’. That’s an indicator that a stock is overbought, which is a scientific term for ‘it went a bit too high’. Or low.

The company was drifting off the overbought RSI, and started dropping out of a post-COVID uptrend, when it had a major hiccup – a large number of their EFTPOS terminals went dark.

Understanding the opportunity

For a connoisseur of the bounce, this is just the sort of situation under which you might want to add this company to your watchlist.

The very next thing you would want is to have a clear understanding of when the absolute worst moment is in, and what could form the catalyst for a rebound.

At some point you’ll need to decide whether this company is going to go broke or recover from a bad experience.

In Tyro’s case, short-sellers were circling and putting out their opinion to the financial press, with headlines questioning their ability to survive.

The stock drop then started to speed up, down from a high of $4.50 to $3, then a slight flutter before the bounce traders favourite indicator occurred; total, panicked capitulation.

The stock went into freefall.

Notice that the stock is now ‘oversold’ on the RSI. And Tyro goes into a trading halt.

Something either very bad is about to happen – and shareholders are going to cop some more of the same pummelling. Or perhaps not so bad – and the stock might just have a violent rebound.

This is the time to have your news alert set.

Staying on top of the opportunity

As an active trader, I run a lot of alerts – volume, price, news.

With Marketech, our live alerts are totally free as part of our ‘Focus’ package – there’s no nickel and diming for each individual alert.

Mainly because I have a job, and can’t stare at the screen all day.

Personally, I don’t use an email alert (but it can be), because I get too many emails already, although they are available.

It’s not an SMS alert, because your current online broker probably charges you 50c for each one of those – even if you don’t notice it. It’s a free notification from our app, because that’s how technology works nowadays. You don’t even have to open your phone to see it, and it cuts through the noise of less important things, like work.

The next stage in our story is somewhat predictable.

Armed with an RSI that is oversold, a bundle of short sellers that are itching to re-buy the stock (that they have sold without owning it and have to buy back), a solid period of raw capitulation, a seemingly endless stretch of negativity from the media and a trading halt, then surprise, surprise, the company releases a positive update to remind you that their world is not ending.

Even without the tech performing at its peak, they are still processing more transactions than the year prior. They are getting the EFTPOS terminals back online, this isn’t the end, it’s probably just a glitch. They directly address the “false” claims of the short-sellers.

The stock reopens.

It opens strong and rallies hard.

Unless the short-sellers have some new claim, the herd is against them and they probably have to buy back that stock alongside the normal punters, who are looking for oversold stocks to buy on a catalyst. Twice the demand.

The reward for taking advantage of the opportunity

So, during the same day, the stock is up from $2.60 to $2.90, meaning a $10k trade would be worth $11,200 less brokerage. Take off the cost of brokerage, which would be $10 ($5 for each leg if you were trading at Marketech), and boom, you’ve made enough to treat yourself to a PS5 for Christmas in just one day.

Bounce!

It is high risk. It is sometimes referred to as catching the falling knife. So be careful. Use your charts and alerts and decide what you are prepared to lose beforehand if you are wrong, because this trade doesn’t play out like this every time (otherwise I’d be floating around on my mega-yacht).

But arming yourself with the right tools can mean that you’re well equipped to spot, stay across and take advantage of these opportunities when they arise.

The right tool for the job

At Marketech our platform is about technology, providing you the tools and technology to trade.

You get live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC. You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k.

Whether your trading style is bounce, growth, value, buy and hold or a combination of all of these, Marketech is a data platform built to give you the edge.

Our special offer for Ausbiz subscribers

Exclusive to AusBiz subscribers, we're offering a 30 day free-trial of our platform, including live-streamed pricing, premium charting tools and ultra-low brokerage, plus the opportunity to get priority access to the upcoming Nico Resources IPO.

Click below to sign up today and take your investing to the next level.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.