Frequently asked questions

About Marketech

Yes, we are an Australian public company - Marketech Online Trading Pty Ltd (ACN 654 674 432) | Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927).

While we have been building trading platforms for 20 years, Marketech Focus is our first platform that has been made available to regular ASX investors.

Our Focus platform is built with technology and services from Australia’s leading providers of data, banking and trading technology:

• Macquarie for banking to hold our clients’ balances

• OpenMarkets to settle trades

• IRESS for trade placement

• Refinitiv for market data.

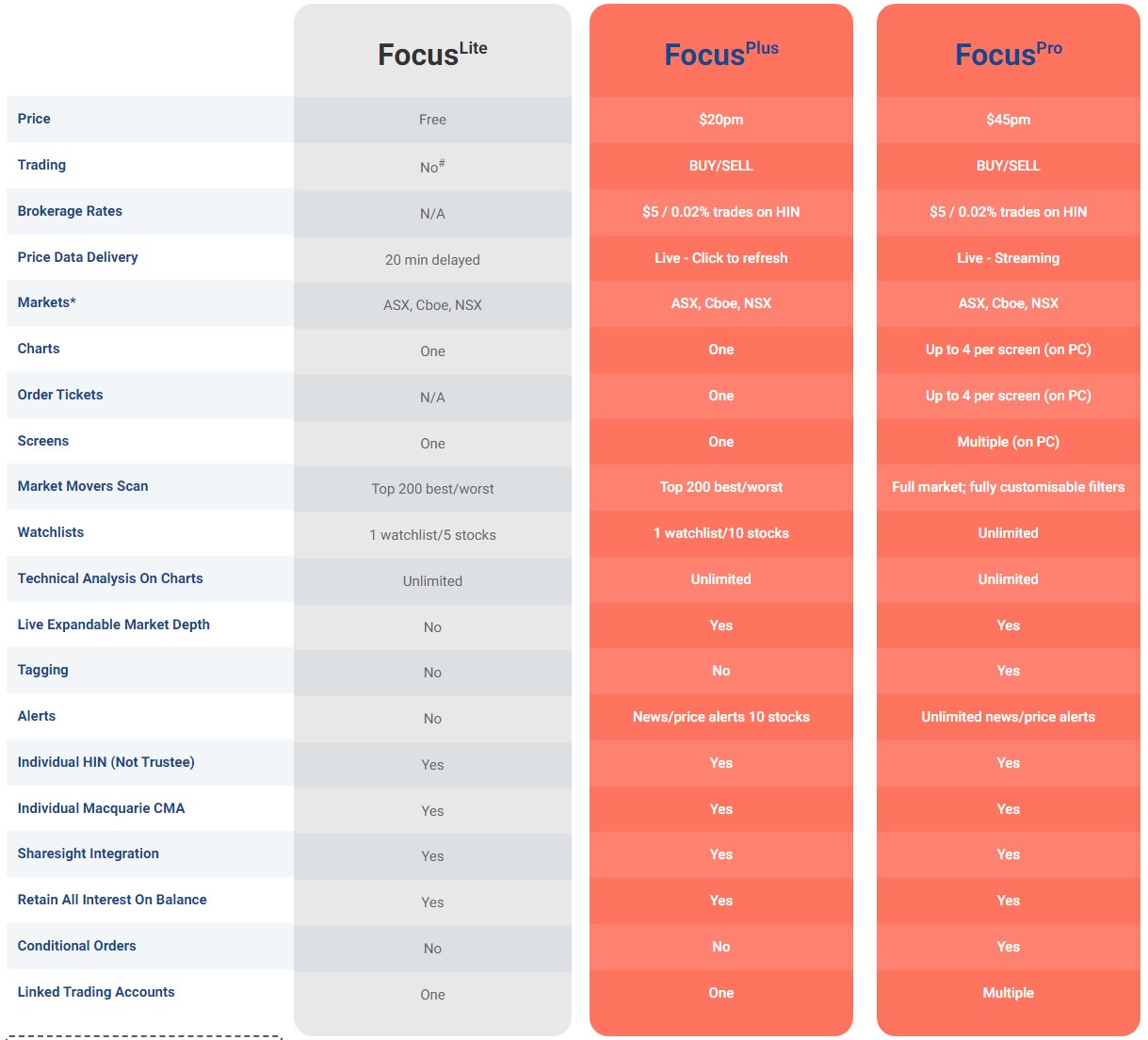

Access to live data incurs a cost from ASX, which we need to cover so we decided that, unlike most of our competitors, if we charge a flat rate to cover the ASX cost, then we can pass the cost of brokerage straight on to our clients. That way, you get the best possible rate, and we get to concentrate on building the best possible trading platform.

We have a range of platform access options available to suit all needs – from casual market observers to active traders. Access to our platform is available at no cost, enabling all traders to take advantage of our market analysis tools, ASX data on a 20-minute delayed basis and low brokerage fees. If you are trading a couple of times a month and only infrequently viewing the live markets, then FocusPlus should be more than sufficient, with live click-to-refresh ASX data, market analysis tools, and low brokerage fees.

Our most popular FocusPro tier is available for $45 per month, delivering live streaming price data, market analysis tools, and low brokerage fees as well as additional features such as multi-chart and multi-screen functionality, unlimited watchlists and unlimited news/price alerts.

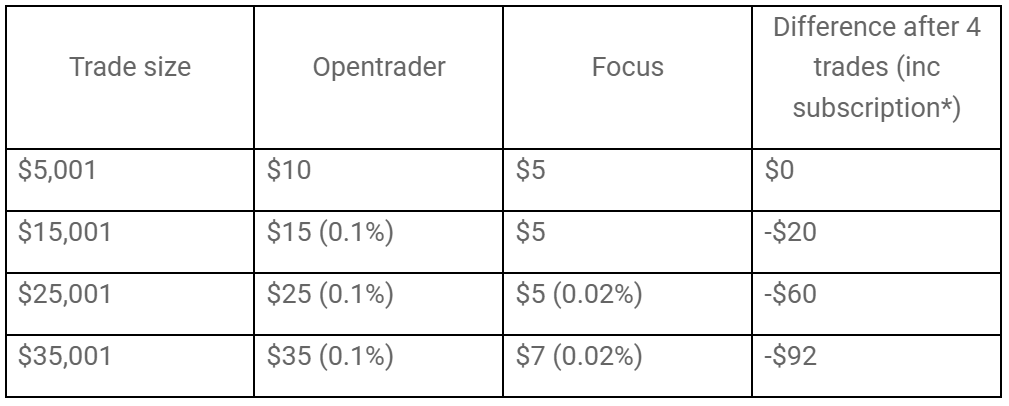

For most traders who trade more than 4 times per month, the cost of the subscription is more than outweighed by the lower brokerage fees compared to most other online brokers, meaning that the overall cost to trade is significantly lower.

For example:

* $20 per month FocusPlus subscription

Trading

We are focussed on delivering ASX investors the best experience possible, which means you are able to invest in any ASX-listed or NSX-listed share. We intend to expand this offering soon.

# Not likely to be trading this month? FocusLite is designed to provide you the ability to maintain access to your trading account, and the market, for free. Then when you’re ready simply upgrade again to start trading.

* All orders automatically check the Cboe market when placed, however only Cboe listed ETF orders can be placed directly into the Cboe market.

In keeping with ASX rules, the smallest trade you can place is $500.

No, this is a long only ASX platform.

As with all ASX brokers, we offer two-day settlement (also known as T+2). This means that when you sell shares, the money from the sale will be deposited into your account on the third business day after the trade. You can however use the funds from a sale to make a purchase immediately.

You can choose to direct them to your new Macquarie CMA, or elect to direct them to any other bank account via the share registry.

Funds can be withdrawn from your Macquarie CMA online through your own Macquarie log-in, as with any other bank account.

Ownership of your shares and balance

Your shares are held on your HIN, registered with ASX on the CHESS register. Shares bought through Marketech are real shares, not CFDs.

Yes, you will receive the full interest that Macquarie is currently paying on their Cash Management Account.

Account set-up

Setting up an account is quick and easy:

1) Select your membership level

2) Complete the application form

3) Wait for approval. The ID verification and account approval process can take between 2-5 business days due to Anti-Money Laundering and Counter Terrorism checks. These checks are necessary to protect your assets - we do not take shortcuts when it comes to protecting our clients’ interests.

To set up your trading account, you’ll need to supply an item of Government issued ID to verify your identity and comply with anti-money laundering regulations, and your Tax File Number to register your account with the ATO.

The fastest way to prove your identity is using our online electronic verification service, which requires a valid Australian Drivers licence.

Yes, you can use your own HIN – transferring across is a simple process.

However, if you would like to get started as quickly as possible, you can open a new HIN and then transfer your existing shares across when you are ready.

Yes, as long as they are in the same name. You will just need to complete a form to let us know which shares you would like to transfer. We’ll take care of the rest.

To reduce paperwork and speed up the account opening process, we set up a new Macquarie Cash Management Account for each of our clients. You cannot currently use an existing bank account, whether that is with Macquarie or another bank

Money can be transferred from a bank to your new Macquarie CMA in the normal fashion. Something to note, is that your balance will be available in the Marketech platform the day after it arrives in your Macquarie CMA as cleared funds.

Not at this time.

You will have full access to your trades within the platform. For those that would like a portfolio and tax reporting service, our fully integrated connection to Sharesight delivers a seamless experience. To enable this, register set up your account on the Sharesight website first, then link your Marketech account within our platform.

Marketech engages Openmarkets Australia Limited (Openmarkets) to facilitate the trading and settlement of transactions on your account.

Openmarkets are:

- An Australian Financial Services Licensee (AFSL 246705);

- A Market Participant of ASX, Chi-X and NSX; and

- An ASX Clear and Settlement Participant.

Instantly access live market data and test our powerful trading tools

Get free, instant access to live data for 14 days and experience the ease of placing trades at the speed of the market with our practice trading account.